All Categories

Featured

IUL contracts safeguard versus losses while using some equity risk premium. High-net-worth individuals looking to lower their tax obligation problem for retired life may profit from spending in an IUL.Some investors are far better off purchasing term insurance coverage while maximizing their retired life plan contributions, rather than buying IULs.

If the underlying supply market index goes up in a given year, owners will see their account boost by a proportional quantity. Life insurance coverage business make use of a formula for figuring out just how much to attribute your cash equilibrium. While that formula is connected to the performance of an index, the quantity of the credit rating is usually going to be less.

Employers typically give matching contributions to 401(k)s as an advantage. With an indexed universal life policy, there is a cap on the quantity of gains, which can limit your account's development. These caps have yearly ceilings on account credits. So if an index like the S&P 500 rises 12%, your gain could be a portion of that amount.

Prudential Iul

If you drop right into this category, consider chatting to a fee-only monetary consultant to talk about whether acquiring permanent insurance policy fits your general approach. For several financiers, however, it might be better to max out on contributions to tax-advantaged retirement accounts, specifically if there are contribution suits from an employer.

Some plans have actually an assured rate of return. One of the crucial attributes of indexed universal life (IUL) is that it offers a tax-free circulations.

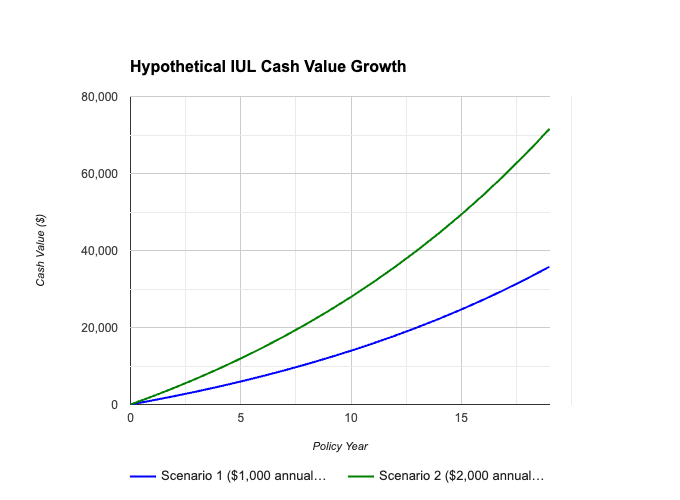

Ideal for ages 35-55.: Offers flexible insurance coverage with moderate money value in years 15-30. Some things customers need to think about: In exchange for the death benefit, life insurance products charge fees such as mortality and expenditure threat charges and abandonment charges.

Retired life planning is essential to keeping financial security and retaining a specific standard of living. of all Americans are bothered with "maintaining a comfortable standard of life in retired life," according to a 2012 study by Americans for Secure Retired Life. Based on current stats, this bulk of Americans are justified in their concern.

Department of Labor approximates that an individual will certainly require to maintain their existing requirement of living once they start retired life. Furthermore, one-third of united state homeowners, in between the ages of 30 and 59, will not be able to preserve their standard of living after retirement, even if they delay their retirement up until age 70, according to a 2012 research by the Fringe benefit Study Institute.

Penn Mutual Iul

In 2010 even more than 80 percent of those between age 50 and 61 held financial debt, according to the Social Safety And Security Administration (SSA). The ordinary financial debt amount amongst this age was greater than $150,000. In the same year those aged 75 and older held an average debt of $27,409. Alarmingly, that figure had greater than doubled considering that 2007 when the ordinary financial obligation was $13,665, according to the Fringe benefit Study Institute (EBRI).

Demographics Bureau. In addition, 56 percent of American senior citizens still had arrearages when they retired in 2012, according to a study by CESI Financial obligation Solutions. What's even worse is that past research study has actually revealed financial debt among retirees has actually gotten on the surge throughout the previous few decades. According to Boston University's Facility for Retired life Study, "In between 1991 and 2007 the number of Americans in between the ages of 65 and 74 that submitted for bankruptcy raised an astonishing 178 percent." The Roth Individual Retirement Account and Policy are both tools that can be made use of to develop significant retired life savings.

These financial devices are comparable in that they profit insurance policy holders that want to create financial savings at a reduced tax rate than they may experience in the future. The policy grows based on the passion, or rewards, credited to the account - iule cross.

That makes Roth IRAs ideal savings vehicles for young, lower-income workers who live in a lower tax obligation bracket and who will certainly take advantage of years of tax-free, compounded development. Because there are no minimum required payments, a Roth IRA gives financiers control over their individual objectives and run the risk of resistance. Furthermore, there are no minimum called for distributions at any age during the life of the plan.

a 401k for employees and companies. To contrast ULI and 401K strategies, take a minute to comprehend the basics of both products: A 401(k) lets staff members make tax-deductible contributions and delight in tax-deferred development. Some companies will certainly match component of the employee's contributions (IUL vs 401(k): A Comprehensive Comparison). When staff members retire, they generally pay tax obligations on withdrawals as regular income.

Iul Vs 401(k): A Comprehensive Comparison

Like various other irreversible life plans, a ULI policy likewise assigns component of the costs to a money account. Because these are fixed-index policies, unlike variable life, the policy will likewise have a guaranteed minimum, so the cash in the cash account will not lower if the index declines.

Policy owners will also tax-deferred gains within their cash account. fidelity iul. Explore some highlights of the advantages that global life insurance policy can use: Universal life insurance plans do not impose limits on the size of plans, so they may provide a method for workers to conserve more if they have already maxed out the Internal revenue service limitations for various other tax-advantaged financial products.

The IUL is far better than a 401(k) or an IRA when it comes to conserving for retired life. With his virtually 50 years of experience as a financial strategist and retired life preparation expert, Doug Andrew can show you precisely why this is the instance.

Latest Posts

Are Iul A Good Investment

Iul Master

Best Variable Life Insurance