All Categories

Featured

Table of Contents

There is no one-size-fits-all when it comes to life insurance policy./ wp-end-tag > In your busy life, monetary self-reliance can appear like a difficult goal.

Pension, social protection, and whatever they 'd taken care of to conserve. It's not that simple today. Less employers are providing typical pension plan plans and numerous business have decreased or discontinued their retirement plans and your ability to rely entirely on social protection remains in inquiry. Also if benefits haven't been reduced by the time you retire, social security alone was never planned to be adequate to pay for the lifestyle you desire and should have.

/ wp-end-tag > As component of an audio monetary strategy, an indexed global life insurance coverage plan can assist

you take on whatever the future brings. Prior to devoting to indexed universal life insurance policy, here are some pros and disadvantages to consider. If you select a great indexed universal life insurance plan, you might see your cash money value expand in value.

Fixed Index Universal Life Insurance Policy

If you can access it beforehand, it may be advantageous to factor it into your. Given that indexed global life insurance policy needs a specific degree of danger, insurance provider tend to keep 6. This kind of plan likewise uses (universal life insurance canada). It is still ensured, and you can adjust the face quantity and motorcyclists over time7.

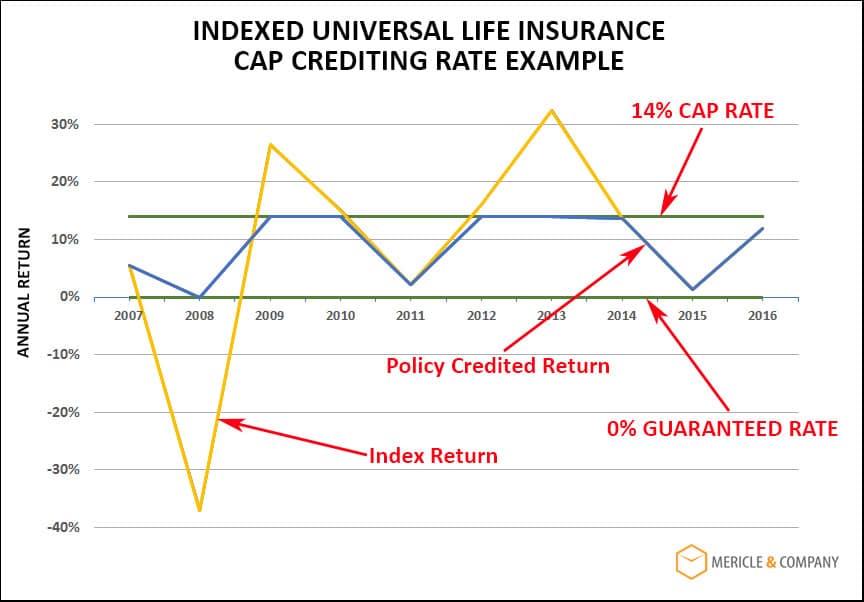

If the chosen index does not execute well, your money worth's growth will certainly be affected. Generally, the insurer has a vested rate of interest in performing better than the index11. Nonetheless, there is typically an ensured minimum rate of interest, so your plan's development will not fall listed below a certain percentage12. These are all elements to be considered when selecting the very best kind of life insurance policy for you.

Universal Life Insurance Tax Advantages

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

Since this type of plan is a lot more complicated and has a financial investment element, it can often come with greater premiums than various other policies like whole life or term life insurance coverage. If you do not think indexed universal life insurance is ideal for you, below are some options to take into consideration: Term life insurance policy is a temporary plan that typically offers insurance coverage for 10 to three decades.

When choosing whether indexed global life insurance policy is ideal for you, it is very important to think about all your options. Whole life insurance policy may be a much better choice if you are trying to find even more security and consistency. On the other hand, term life insurance policy might be a much better fit if you just need coverage for a particular time period. Indexed global life insurance policy is a kind of policy that offers much more control and flexibility, in addition to higher money value development possibility. While we do not offer indexed universal life insurance policy, we can give you with more details about whole and term life insurance coverage policies. We advise exploring all your choices and talking with an Aflac agent to find the finest suitable for you and your household.

The remainder is included to the cash money value of the plan after costs are subtracted. The money worth is attributed on a regular monthly or yearly basis with passion based on rises in an equity index. While IUL insurance may prove useful to some, it is necessary to comprehend just how it works before acquiring a plan.

Table of Contents

Latest Posts

Are Iul A Good Investment

Iul Master

Best Variable Life Insurance

More

Latest Posts

Are Iul A Good Investment

Iul Master

Best Variable Life Insurance